Lithuania’s E-mobility Sector

- Why Lithuania

- Key investment areas

- Already here

- Downloads

- News & Events

- Why Lithuania

- Key investment areas

- Already here

- Downloads

- News & Events

Lithuania stands at the forefront of the E-mobility revolution. With its strategic geographic location, skilled talent pool, and solid infrastructure, the country offers an ideal environment for companies developing and manufacturing electric vehicles and associated e-mobility technologies. Lithuania’s supportive regulatory framework and commitment to green energy further enhance its appeal as a prime destination for E-mobility investments.

-

22%of Lithuania’s total value added is generated by the manufacturing sectorSource: Lithuanian Statistics, 2023

-

2nd in the EUfor greenfield FDI performanceSource: fDi Intelligence Greenfield FDI Performance Index, 2023

-

2nd in CEEin for innovationSource: Consumer Technology Association International Innovation Scorecard, 2023

Strategic Advantages

of Investing in Lithuania’s

E-mobility Sector

Innovative Talent Pool

Lithuania boasts a highly educated workforce with strong expertise in engineering, IT, and manufacturing. The country ranks 1st globally for digital skills availability and has a high percentage of STEM graduates. This talent pool, coupled with flexible education programs tailored to industry needs, drives innovation and efficiency in the E-mobility sector.

-

5th in the EUfor science, math, computing, engineering, manufacturing and construction bachelor graduates in young adult populationSource: Eurostat, 2022

-

1st in the EU56% of scientists and engineers are womenSource: Eurostat, 2023

-

1st globallyfor the availability of digital skillsSource: IMD World Competitiveness Yearbook, 2023

Strategic Location and Infrastructure

Lithuania is positioned at the crossroads of Europe, providing seamless access to key markets. The country’s high-quality roads, logistics hubs, and reliable networking solutions support efficient supply chain management, making it an ideal base for E-mobility companies. Lithuania is well-connected by sea, air, road, and rail, ensuring comprehensive business needs are met.

The connectivity you need:

-

Vital connecting point on the East-West and North-South transport corridors, ranking 2nd in CEE for road quality.

Source: World Economic Forum, Global Competitiveness Report, 2022

-

Rail Baltica railway will connect Finland to Germany, with passenger and cargo terminals in Lithuania.

-

Klaipėda State Seaport is the leading port in the Eastern Baltics for container handling.

-

Lithuania’s 3 international airports provide access to major European cities within 2-3 hours.

-

Competitive rates for logistics services due to strong presence of local and international logistics companies.

-

Ready-to-build landplots:

-

7 Free Economic Zones (FEZ) – ready-to-build industrial sites with physical infrastructure and support services in place.

-

Companies operating in FEZs are subject to a facilitated tax regime.

-

In a number of FEZs, >80% of newcomers exceed their initial plans within two years.

-

-

Government Support and Financial Incentives

Lithuania offers substantial government support and financial incentives for E-mobility businesses. Companies can benefit from grants for research and development, tax exemptions in Free Economic Zones (FEZ), and streamlined regulatory processes. These incentives ensure quick establishment and smooth operation.

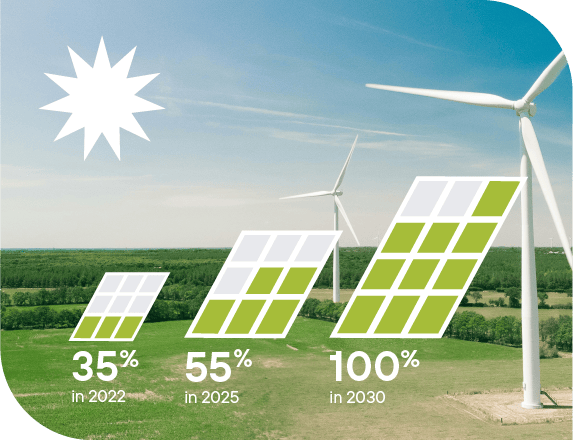

Commitment to Green Energy

Lithuania aims for 100% renewable energy in final electricity consumption by 2030 and carbon neutrality by 2025. Two offshore wind parks, set to begin operation in 2028, will generate up to 6 TWh of green electricity per year, meeting up to half of Lithuania’s current electricity demand.

-

-

70%

In 2023, 70% of the country’s total energy output was produced from renewable sources.Source: Ministry of Energy, 2024

-

696M EUR

earmarked for renewable energy expansion under the LT100 support scheme.Source: Ministry of Finance, 2023

-

2.8 GW

of offshore wind power to be generated in Lithuania by 2040Source: Ministry of Energy, 2024

-

-

Expected share of renewable energy in the final balance of electricity consumption in Lithuania

Source: National energy and climate action plan of the Republic of Lithuania 2021-2030

Source: National energy and climate action plan of the Republic of Lithuania 2021-2030

Political Stability

Lithuania is known for its strong commitment to stability, transparency, and integrity. The country consistently ranks high in global corruption perception indices, upholds the rule of law, and promotes ethical business practices, making it a reliable and stable environment for investments.

-

Global Corruption IndexRisk Rank

Source: Global Risk Profile, 2022

-

Work values

Lithuania is Ideal for these E-mobility Investments

- Electronic components

- E-bike assembly

- Micromobility components

Electronic components

Lithuania’s manufacturing strength, bolstered by Hella and Continental, offers ideal conditions for electronic components. With well-developed infrastructure, supportive regulations, and skilled talent, Lithuania is ready for efficient and competitive operations.

E-bike assembly

Lithuania’s central location, skilled workforce, business-friendly environment, and advanced logistics make it perfect for e-bike assembly. Successful examples like Pon.Bike highlight its potential in the growing e-bike market.

Micromobility components

Lithuania’s strategic location, manufacturing expertise, and emerging micromobility ecosystem make it ideal for micromobility component manufacturers. Positioned for efficient supply chains and close to key markets, Lithuania offers significant opportunities in this evolving industry.

E-mobility Companies in Lithuania

Micromobility companies

-

The largest OEM Bike Manufacturer in Northern Europe, Baltik Vairas exports top-quality bicycles to Germany, Netherlands, Denmark, Switzerland, Austria, Finland, and other countries.

-

The world’s leading bicycle company will open a new manufacturing facility in Kėdainiai FEZ in June 2024, months earlier than planned.

-

Another global brand has a manufacturing location right next to capital city of Vilnius. The company specializes in city commute e-bikes and has a capacity of more than 50,000 bicycles yearly.

-

A Lithuanian company employing more than a 100 people and having a capacity of 60,000+ bicycles. The company manufactures under it’s own brand as well as assemble bicycles for other brands in Europe

Automotive companies

Automotive companies in Lithuania manufacture complex, high value-added products such as intelligent glass control and radar sensors. Major industry players like Hella and Continental have leveraged local engineering talent and tax incentives to rapidly set up and scale production.

Lithuania's E-mobility sector is home to numerous success stories, demonstrating the potential and growth of this industry. Benefit from the supportive business environment and thrive in the competitive E-mobility market.

Related materials

to download

What’s happening

in the sector

-

ManufacturingUS Window Maker INTUS to Build Additional Plant in ŠiauliaiJul 09, 2024

ManufacturingUS Window Maker INTUS to Build Additional Plant in ŠiauliaiJul 09, 2024 -

New investmentsDefence industry giant Rheinmetall signs agreement to establish operations in LithuaniaJun 03, 2024

New investmentsDefence industry giant Rheinmetall signs agreement to establish operations in LithuaniaJun 03, 2024 -

ManufacturingRyanair expands in Kaunas: €20M investment, 200 new jobs and 4 new routesMay 14, 2024

ManufacturingRyanair expands in Kaunas: €20M investment, 200 new jobs and 4 new routesMay 14, 2024