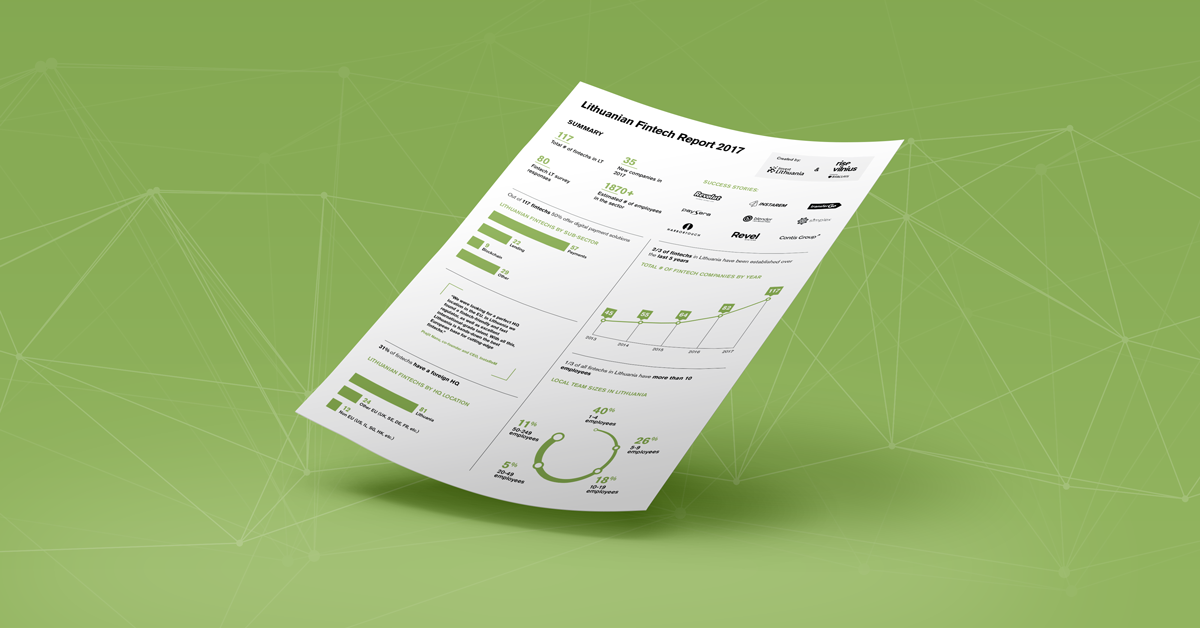

Based on the recently released Lithuania Fintech Report 2017, a total of 117 fintech companies were operating in the country in 2017, with 35 of them being registered last year. The overall number of startups grew by nearly 43% year-over-year. According to Invest Lithuania, a co-author of the Report, the reasons behind choosing Lithuania were multifold: a growing talent pool, hassle-free regulation, flexible banking infrastructure, and the ability to access half a billion customers in Europe.

Fintech-friendly regulator opens gateway to Europe

One of the main advantages Lithuania can offer foreign companies are the keys to the entire EU market. Coincidentally, according to the Lithuania Fintech Report 2017, 96% of all fintechs in the country see Europe as their target market. What sets Lithuania apart from other potential investment destinations inside the EU is a significantly narrower timeframe required to get licensed.

“We were looking for a perfect HQ location in the EU,” claims Prajit Nanu, co-founder and CEO at InstaReM, a Singapore-based startup that came to the country in 2017. “In Lithuania we found a fintech-friendly and fast regulator, as well as excellent international-grade talent. With all this, Lithuania is hands-down the best European base for cutting-edge fintechs.”